Market conditions drive strong June housing sales

VANCOUVER, B.C. July 3, 2009Â The combination of low interest

rates and more affordable pricing helped propel Greater Vancouver home

sale numbers to the second all-time highest total for the month of

June.

The Real Estate Board of Greater Vancouver (REBGV) reports that sales

of detached, attached and apartment properties increased 75.6 per cent

in June 2009 to 4,259, from the 2,425 sales recorded in June 2008. The

figure is just short of the record-breaking 4,333 sales which occurred

in June 2005.

New listings for detached, attached and apartment properties declined

17.9 per cent to 5,372 in June 2009 compared to June 2008, when 6,546

new units were listed. However, new listings increased 13.5 per cent

from May to June of this year. Total active listings in Greater

Vancouver currently sit at 13,252, down 27 per cent from June 2008 and

2.9 per cent below the active listings count at the end of May 2009.

“Price reductions and low interest rates have created an improvement

in affordability, which is causing the number of sales to rise to

levels comparable to 2003 to 2007,” Scott Russell, REBGV president

said.

“Many people who were reluctant to purchase a home last fall and

earlier this year are returning to the market because they see

conditions that appeal to their personal and financial needs,”

Russell said. “However, the current marketplace is such that buyers

are more inclined to walk if they don’t like the terms of an

offer.”

Residential benchmark prices, as calculated by the MLSLink? Housing

Price Index, declined 8.2 per cent to $518,855 in June 2009 compared

to June 2008.

The number of sales of detached properties increased 81.6 per cent to

1,667 from the 918 detached sales recorded during the same period in

2008. The benchmark price for detached properties declined 8.4 per

cent to $701,384 in June 2009 compared to June 2008.

The number of sales of apartment properties in June 2009 increased

69.3 per cent to 1,790, compared to 1,057 sales in June 2008. The

benchmark price of an apartment property declined 8.2 per cent from

June 2008 to $356,880.

The number of attached property sales in June 2009 increased 78.2 per

cent to 802, compared with the 450 sales in June 2008. The benchmark

price of an attached unit declined 7.3 per cent between June 2009 and

2008 to $441,620.

Bright spots in Greater Vancouver in June 2009 compared to June 2008:

Detached:

Burnaby up 109.7 per cent (151 units sold from 72)

Coquitlam up 122.2 per cent (160 units sold from 72)

Delta – South up 107.7 per cent (56 units sold from 27)

Maple Ridge/Pitt Meadows up 54.3 per cent (162 units sold from 105)

New Westminster up 104.8 per cent (43 units sold from 21)

North Vancouver up 96.2 per cent (153 units sold from 78)

Port Moody/ Belcarra up 120 per cent (33 units sold from 15)

Richmond up 77.4 per cent (204 units sold from 115)

Squamish up 107.7 per cent (27 units sold from 13)

Sunshine Coast up 33.9 per cent (75 units sold from 56)

Vancouver East up 71.2 per cent (238 units sold from 139)

Vancouver West up 85.2 per cent (200 units sold from 108)

West Vancouver/Howe Sound up 117.8 per cent (98 units sold from 45)

Attached:

Burnaby up 81.8 per cent (140 units sold from 77)

Coquitlam up 80 per cent (54 units sold from 30)

Maple Ridge/Pitt Meadows up 48.6 per cent (55 units sold from 37)

North Vancouver up 121.2 per cent (73 units sold from 33)

Port Coquitlam up 82.6 per cent (42 units sold from 23)

Port Moody/ Belcarra up 77.3 per cent (39 units sold from 22)

Richmond up 84.5 per cent (155 units sold from 84)

Vancouver East up 118.5 per cent (59 units sold from 27)

Vancouver West up 121.8 per cent (122 units sold from 55)

Apartments:

Burnaby up 60.4 per cent (239 units sold from 149)

Coquitlam up 93.9 per cent (95 units sold from 49)

New Westminster up 57.1 per cent (121 units sold from 77)

North Vancouver up 71.4 per cent (120 units sold from 70)

Port Coquitlam up 58.1 per cent (49 units sold from 31)

Port Moody/Belcarra up 128.6 per cent (48 units sold from 21)

Richmond up 54.1 per cent (225 units sold from 146)

Vancouver East up 58.7 per cent (165 units sold from 104)

Vancouver West up 87.2 per cent (627 units sold from 335)

West Vancouver/Howe Sound up 155.6 per cent (23 units sold from 9)

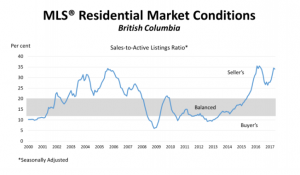

The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.