Interesting analysis of the mortgage market and the different terms from Graham Connor

Variable Rates:

Current forecasts call for no rate hikes until next year. Clients with existing variable rate contracts are unlikely to consider locking in at this time.

Here’s an example of what clients might be considering for new contracts. Assuming a 30 year amortization, the monthly payment per $100k borrowed for a five year fixed rate at 3.49% stands at $447.09. The variable rate of 2.2% means a monthly payment of $379.70 per $100k. Using a $400,000- mortgage example, the incentive to take the variable rate is the savings of $269.56 per month. The precise savings also requires an outstanding balance calculation, as the lower the interest rate in the terms, the lower is the balance at the end of the term.

My advice to those contemplating a new variable rate mortgage:

- voluntarily set payments as if you are paying rates at 5% or higher so pre-adjust to the inevitable rate increases. Increased payment all go to reduce the loan balance.

- plan your budget to see if you can manage rates above 5%

- watch my rate bulletins not only for the Prime rate increases, but for the fixed rate increases to see what you may be locking into. Set a tolerance level – I’m happy to assist in any mortgage reviews and payment plans

- variable rates best suit those with more equity in their home and those who easily qualify by the strict debt service guidelines set by mortgage lenders

- consider the hybrid mortgages to mitigate the effect of the possibility of interest rate shock

- Since April 19th, expect to qualify for less on a variable rate if you have less than 20% down payment compared to a five year fixed rate

Fixed Rates

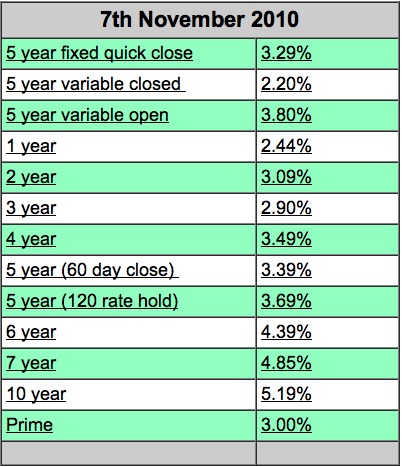

The aim of this newsletter is to provide direction on interest rate movements. For the first time in nearly three years, there are no changes since last month. Fixed rates are pretty much at the floor and not expected to fall further. My rates shown below are for owner-occupied mortgages with clients qualifying on the basis of proving income. As not all lenders offer mortgages for rental properties, or to those applying in the basis of equity, please ask for specific assessments.

The current spread between the best discounted five year variable and fixed rates edges closer to 1%. That 1% represents the premium paid for security against future rate increases and is reduced from 1.75% in February this year. First-time buyers, those on a limited budget, the risk-averse or those who believe fixed rates offer best value can now access the lowest rates ever seen.