Expert Advice: Should You Rent or Sell?

Expert Advice from Nicholas Meyer of Downtown Suites

One of the biggest questions we have right now, and one I was asked just this week by a client of ours, is whether the person should rent or sell. And this is a question that pops up a lot in people’s minds. If they’ve held a property for a number of years and the market’s improved, it seems to be waning – should they jump ship now before it goes down further, or should they hold? These are questions I get asked on quite a regular basis.

The first thing that you have to look at is what’s going on in the market, how much demand is for my property and what did I originally pay for it? Have I made a profit?

And then more importantly I think, because I never believe in selling anything unless there’s a reason for it: possibly you’re not happy with the way the building is being run or you don’t like the fact that there have been too many transient people moving in to the property, or various other things: you don’t like the upkeep, the strata corporation is not maintaining the property as well as they might. There are a few things like that. And by all means when those things happen you should always follow your intuition and move on, and place your funds somewhere else where you will probably have a better investment.

One of the things that you really need to think about is, “If I sell it, what am I going to do with the funds that I realize from the sale?”Maybe it’s that time in your life when you do want to go on a couple of around the world vacations or buy that big tv or diamond ring or whatever. But the reality is that the investment vehicle is lost. You may want to pay down your own mortgage on your own home, and be mortgage-free, which is also another good thing to do.

But really make sure that you have some viable vehicle to place the funds in. Maybe it’s another property, or maybe it’s an oil well, but I think that’s one of the big things.

Also, “Am I getting a good rent? Do I like the rental return I’m getting? I’m getting a good monthly income, am I going to miss that? Am I going to be able to get as much money if I move the funds somewhere else?” These are things that are just sort of basic questions, but that’s what you need to ask yourself.

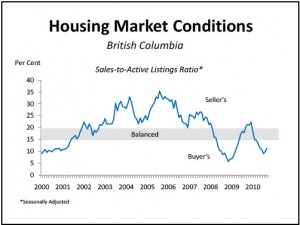

Essentially, “What is going on in the market?” Currently, our market, we have well over 1000 suites for sale right now. Going into the winter market, things will be slower here. We’ve had some good news this week, interest rates are remaining stable, probably not going to be rising till the end of next year. Who knows when, but the government are keeping the rates down, which is keeping mortgage rates down, and should keep our market getting along. We’ve been fortunate to have such a large influx of foreign capital.

Looking around the world, I was just recently in the Middle East, and I’ve been back in Europe. Our prices are not out of line with what’s going on in the rest of the world. There are some places far humbler than Vancouver which is number 1 or number 2 on the most liveable places on the planet to live, that are as expensive or more expensive that here. Yesterday I saw an apartment property in London selling for 140 million, and I think that was pounds – it makes our real estate seem miniscule by comparison. And I know in Amman, in Jordan where I just was there were 5 and 10 million dollar properties supposedly. So our prices here are definitely in line with what’s going on in the rest of the world, and given that we’re such a desirable place to be. I feel we will continue to appreciate in value. We’ll have some lulls and we’ll have some plateaus, but over time we’re going to continue to rise in value.

So, happy investing!