The Bank of Canada announced this morning that it is raising its target for the overnight rate by 25 basis points to 1 per cent. In the press release accompanying the decision, the Bank noted that recent economic data have been stronger than expected but growth is forecast to moderate in the second half of the year. On inflation, the Bank cited some excess capacity and temporary price shocks as factors keeping inflation below its 2 per cent target. Importantly, the Bank mentioned it will be paying particular attention to the evolution of the economy’s potential growth rate (meaning the economy’s estimated long-run growth rate) as well as to labour market conditions and the economy’s sensitivity to higher interest rates.

The Bank has now removed the stimulus it injected into the Canadian economy in 2015 to offset the impact of falling oil prices. With the economy expanding at a 3.5 per cent rate over the past year, that stimulus is clearly no longer required. The Bank seems to be more concerned about the potential for higher future inflation due to an over-heated economy than on the actual very low inflation observed in recent months. That leaves the door open for further rate increases should economic growth remain robust.

The British Columbia Real Estate Association (BCREA) released its 2017 Third Quarter Housing Forecast update today.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 10 per cent to 100,900 units this year, after reaching a record 112,209 units in 2016. Strong economic fundamentals are underpinning consumer demand and are expected to keep home sales at elevated levels through 2018. The ten-year average for MLS® residential sales in the province is 84,700 units.

“British Columbia’s position as the best performing economy in the country is bolstering consumer confidence and housing demand,” said Cameron Muir, BCREA Chief Economist. “Strong employment growth, a marked increase in migrants from other provinces, and the ageing of the millennial generation is supporting a heightened level of housing transactions. However, a limited supply of homes for sale is causing home prices to rise significantly in many regions, particularly in the Lower Mainland condominium market”.

The average MLS® residential price in the province is forecast to increase 3.5 per cent to $715,000 this year, and a further 4.1 per cent to nearly $745,000 in 2018. However, the provincial average price is being skewed lower as the result of a change in the mix and share of homes selling. Fewer detached home sales relative to attached and apartment properties and a larger proportion of home sales occurring outside the Metro Vancouver region are operating to hold back the provincial average price. Home prices in ten of the 11 real estate board areas are forecast to rise at a higher rate than the provincial average.

To view the full BCREA Housing Forecast, click here.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,275 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in July, down 6.3 per cent from the same period last year. Total sales dollar volume was $6.48 billion, down 1.3 per cent from July 2016. The average MLS® residential price in the province was $698,761, a 5.3 per cent increase from the same period last year.

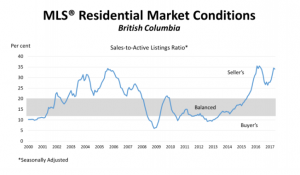

“Strong economic growth, an expanding population base and a lack of supply continue to drive BC home sales and prices this summer,” said Cameron Muir, BCREA Chief Economist. “However, home sales have edged back 4 per cent since May, with active listings beginning to bounce back from a 20-year low,” added Muir. “If these trends continue, it may signal that more balanced market conditions could emerge before the end of the year.”

Year-to-date, BC residential sales dollar volume was down 19.3 per cent to $45.6 billion, when compared with the same period in 2016. Residential unit sales declined 17.0 per cent to 64,107 units, while the average MLS® residential price was down 2.8 per cent to $710,921.

For the complete news release, including detailed statistics, click here.

The Bank of Canada announced this morning that it is raising its target for the overnight rate by 25 basis points to 0.75 per cent. In the press release accompanying the decision, the Bank noted that Canada’s economy has been robust and a significant amount of economic slack has been absorbed. While inflation data has been soft, the Bank expects that this is temporary and that inflation will return to its 2 per cent target by mid-2018.

The Bank of Canada announced this morning that it is raising its target for the overnight rate by 25 basis points to 0.75 per cent. In the press release accompanying the decision, the Bank noted that Canada’s economy has been robust and a significant amount of economic slack has been absorbed. While inflation data has been soft, the Bank expects that this is temporary and that inflation will return to its 2 per cent target by mid-2018.

The motivation for today’s rate increase seems primarily to be that the Bank feels that the stimulus it injected into the Canadian economy in 2015 through two rate cuts is no longer required given a recent trend of strong economic and employment growth. If that is the case, a further 25 basis point increase before the end of the year will likely follow. After that, the pace of rate increases relies heavily on the trend in Canadian inflation, which to date has been well below the Bank’s 2 per cent target. If that trend does not reverse by early next year, the Bank may decide to stop at a 1 per cent overnight rate until higher inflation emerges.

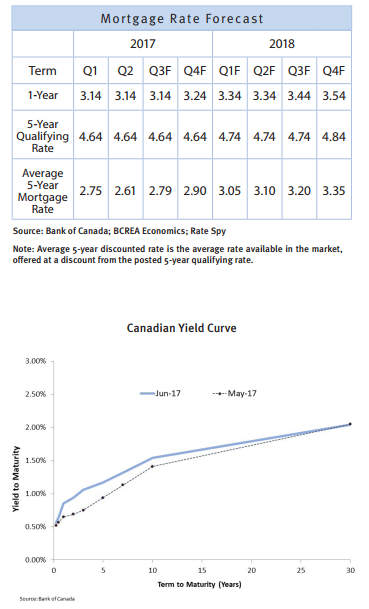

As bond markets reprice rate expectations, Canadian mortgage rates have returned to levels observed at the beginning of the year. We expect that mortgage rates will rise further in the second half of 2017, finishing near 3 per cent for a five-year fixed rate.

For more information, please contact:

| Cameron Muir | Brendon Ogmundson |

| Chief Economist | Economist |

| Direct: 604.742.2780 | Direct: 604.742.2796 |

| Mobile: 778.229.1884 | Mobile: 604.505.6793 |

| Email: cmuir@bcrea.bc.ca | Email: bogmundson@bcrea.bc.ca |

Highlights:

• Hawkish turn at the Bank of Canada?

• Canadian economy heating up

• Falling oil prices and low inflation may keep Bank on hold until 2018

CLICK HERE to read the full report

The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.

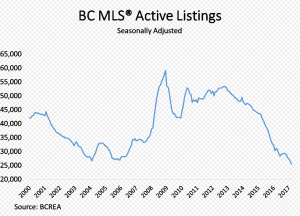

“Market conditions have tightened considerably this spring as an upturn in consumer demand has not been accompanied by a rise in homes listed for sale,” said Cameron Muir, BCREA Chief Economist. “The supply of homes for sale in the province has fallen 50 per cent over the past five years.”

“The entire southern portion of the province is experiencing a shortage of housing supply, which makes continuing upward pressure on home prices inevitable, at least in the near term,” added Muir. Total active listings in the province were down 11.1 per cent to 28,404 units from May 2016. The ratio of home sales to active listings was well over 20 per cent in nine of the province’s 11 real estate boards, and over 50 per cent in Vancouver, the Fraser Valley, Chilliwack and Victoria.

Year-to-date, BC residential sales dollar volume was down 25.2 per cent to $30.6 billion, when compared with the same period in 2016. Residential unit sales declined 20.1 per cent to 43,158 units, while the average MLS® residential price was down 5.7 per cent to $709,541.

For the complete news release, including detailed statistics, click here.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,865 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in April, down 23.9 per cent from the same period last year. Total sales dollar volume was $7.19 billion, down 25.4 per cent from April 2016. The average MLS® residential price in the province was $728,955, a 2 per cent decrease from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 9,865 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in April, down 23.9 per cent from the same period last year. Total sales dollar volume was $7.19 billion, down 25.4 per cent from April 2016. The average MLS® residential price in the province was $728,955, a 2 per cent decrease from the same period last year.

“BC home sales are on an upward trend this spring, led by a sharp increase in consumer demand in the Lower Mainland,” said Cameron Muir, BCREA Chief Economist. The seasonally adjusted annual rate (SAAR) of home sales was over 106,000 units in April, significantly above the five-year SAAR for April of 89,000 units.

The supply of homes for sale declined 17 per cent from April 2016. On a seasonally adjusted basis, active residential listings have declined 50 per cent since 2012 and are now at their lowest level in over 20 years. The imbalance between supply and demand is continuing to drive home prices higher in most regions, further eroding affordability.

Year-to-date, BC residential sales dollar volume was down 31.8 per cent to $21.3 billion, when compared with the same period in 2016. Residential unit sales declined 25.0 per cent to 30,757 units, while the average MLS® residential price was down 9.2 per cent to $692,220.

For the complete news release, including detailed statistics, click here.

BC Real Estate Association (BCREA) Chief Economist Cameron Muir discusses the October 2016 statistics.

BC Housing Demand Remains Mixed in October

Vancouver, BC – November 15, 2016. The British Columbia Real Estate Association (BCREA) reports that 7,272 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in October, down 16.7 per cent from the same month last year. Total sales dollar volume was $4.4 billion in October, down 24.2 per cent compared to the previous year. The average MLS® residential price in the province was $606,787, a decline of 9.1 per cent compared to the same month last year.

“Housing demand remained mixed across the province in October,” said Cameron Muir, BCREA Chief Economist. “Home sales across the Lower Mainland were down from the elevated levels of one year ago, but stabilized on a month to month basis. In contrast, home sales on Vancouver Island and in the interior of the province continue to post strong year-over-year gains.”

“The decline in the average residential price reflects a smaller proportion of transactions in the province originating in Vancouver,” added Muir. Home sales through the Real Estate Board of Greater Vancouver fell to 31.4 percent of BC transactions last month, compared to 42.6 per cent a year ago.

Year-to-date, BC residential sales dollar volume increased 27.4 per cent to $70.4 billion, when compared with the same period in 2015. Residential unit sales climbed by 15 per cent to 101,069 units, while the average MLS® residential price was up 10.8 per cent to $696,992.