With home buyer demand below long-term historical averages in June, the supply of homes for sale continued to accumulate in Metro Vancouver.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,077 in June 2019, a 14.4 per cent decrease from the 2,425 sales recorded in June 2018 and a 21.3 per cent decrease from the 2,638 homes sold in May 2019.

Last month’s sales were 34.7 per cent below the 10-year June sales average. This is the lowest total for the month since 1998.

“We’re continuing to see an expectation gap between home buyers and sellers in Metro Vancouver,” said Ashley Smith, REBGV president. “Sellers are often trying to get yesterday’s values for their homes while buyers are taking a cautious, wait-and-see approach.”

On the supply side, there were 4,751 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in June 2019. This represents a 10 per cent decrease compared to the 5,279 homes listed in June 2018 and an 18.9 per cent decrease compared to May 2019 when 5,861 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 14,968, a 25.3 per cent increase compared to June 2018 (11,947) and a 1.9 per cent increase compared to May 2019 (14,685).

“Home buyers haven’t had this much selection to choose from in five years,” Smith said. “For sellers to be successful in today’s market, it’s important to work with your local REALTOR® to make sure you’re pricing your home for these conditions.”

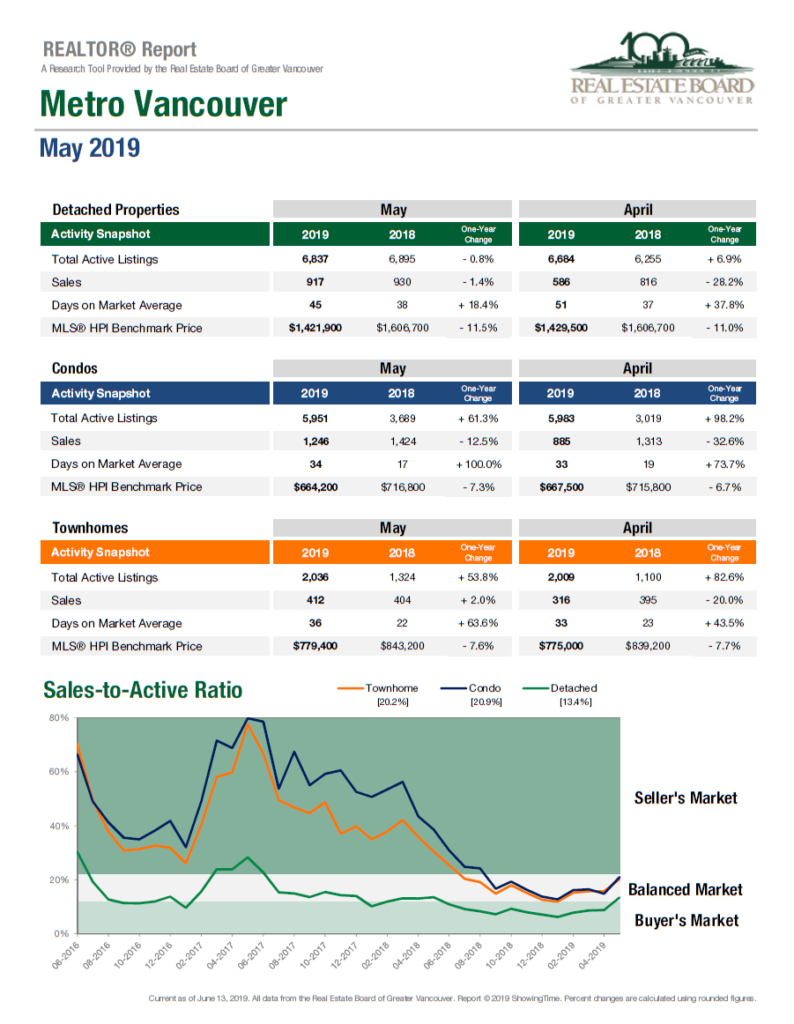

For all property types, the sales-to-active listings ratio for June 2019 is 13.9 per cent. By property type, the ratio is 11.4 per cent for detached homes, 15.8 per cent for townhomes, and 15.7 per cent for apartments.

Generally, analysts say that downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $998,700. This represents a 9.6 per cent decrease over June 2018 and a 0.8 per cent decrease compared to May 2019.

This is the first time the composite benchmark has been below $1 million since May 2017.

Sales of detached homes in June 2019 reached 746, a 2.6 per cent decrease from the 766 detached sales recorded in June 2018. The benchmark price for detached properties is $1,423,500. This represents a 10.9 per cent decrease from June 2018 and a 0.1 per cent increase compared to May 2019.

Sales of apartment homes reached 941 in June 2019, a 24.1 per cent decrease compared to the 1,240 sales in June 2018. The benchmark price of an apartment property is $654,700. This represents an 8.9 per cent decrease from June 2018 and a 1.4 per cent decrease compared to May 2019.

Attached home sales in June 2019 totalled 390, a 6.9 per cent decrease compared to the 419 sales in June 2018. The benchmark price of an attached unit is $774,700. This represents an 8.6 per cent decrease from June 2018 and a 0.6 per cent decrease compared to May 2019.

Download the June 2019 stats package.