Mortgage Rates On The Rise

Mortgage Rate Outlook

The Canadian mortgage market has seen substantial changes in the first six months of 2018, with mortgage credit

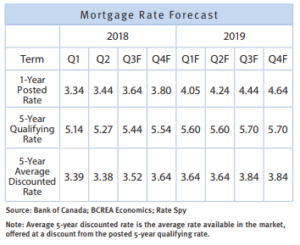

The Canadian mortgage market has seen substantial changes in the first six months of 2018, with mortgage credit  both more expensive and more difficult to access. The B20 stress test for conventional borrowers has slowed overall mortgage credit growth while the five-year qualifying rate for Canadian mortgages has gone up 70 basis points in the past year. Rising

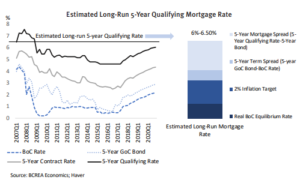

both more expensive and more difficult to access. The B20 stress test for conventional borrowers has slowed overall mortgage credit growth while the five-year qualifying rate for Canadian mortgages has gone up 70 basis points in the past year. Rising  mortgage rates have largely been influenced by tighter monetary policy from the Bank of Canada as strong economic growth has fueled rising inflation. It has been quite some time since Canada was in a true rising interest rate environment. The last cycle of prolonged rate increases was from 2004 to 2007, just prior to the global financial crisis , when the Bank of Canada increased its overnight policy rate ten times over three years. Much about the Canadian economy has changed since that time, and those changes have had substantial implications for the ultimate destination of Canadian interest rates. The Canadian workforce has aged, lowering the growth rate of the Canadian labour force. Further, the sharp decline in commodity prices has meant a scaling back in oil-sector capital investment and subsequent lower productivity growth. Both of these factors have translated into a lower potential, or long-run, rate of economic growth in Canada. That potential growth, in turn, influences the long-run level of interest rates that the Bank of Canada would like to return to once the economy is at full capacity and inflation is at its 2 percent target. Ultimately, a lower potential growth rate means lower interest rates in the long-run. The Bank of Canada estimates the long-run level of its policy rate at 3 to 3.5 per cent. Based on historical averages of interest rate spreads, that implies that the five-year qualifying rate would equal between 6 and 6.5 per cent once the Bank of Canada closes the gap between the overnight rate and the Bank’s longrun or equilibrium overnight rate. Based on our outlook for Canadian economic growth and inflation, it is likely we will see the five-year qualifying rate near that destination by the end of 2020.

mortgage rates have largely been influenced by tighter monetary policy from the Bank of Canada as strong economic growth has fueled rising inflation. It has been quite some time since Canada was in a true rising interest rate environment. The last cycle of prolonged rate increases was from 2004 to 2007, just prior to the global financial crisis , when the Bank of Canada increased its overnight policy rate ten times over three years. Much about the Canadian economy has changed since that time, and those changes have had substantial implications for the ultimate destination of Canadian interest rates. The Canadian workforce has aged, lowering the growth rate of the Canadian labour force. Further, the sharp decline in commodity prices has meant a scaling back in oil-sector capital investment and subsequent lower productivity growth. Both of these factors have translated into a lower potential, or long-run, rate of economic growth in Canada. That potential growth, in turn, influences the long-run level of interest rates that the Bank of Canada would like to return to once the economy is at full capacity and inflation is at its 2 percent target. Ultimately, a lower potential growth rate means lower interest rates in the long-run. The Bank of Canada estimates the long-run level of its policy rate at 3 to 3.5 per cent. Based on historical averages of interest rate spreads, that implies that the five-year qualifying rate would equal between 6 and 6.5 per cent once the Bank of Canada closes the gap between the overnight rate and the Bank’s longrun or equilibrium overnight rate. Based on our outlook for Canadian economic growth and inflation, it is likely we will see the five-year qualifying rate near that destination by the end of 2020.

To read more “click here”