The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.

The British Columbia Real Estate Association (BCREA) reports that a total of 12,402 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, down 7.9 per cent from the same period last year. Total sales dollar volume was $9.33 billion, down 4.0 per cent from May 2017. The average MLS® residential price in the province was $752,536, a 4.2 per cent increase from the same period last year.

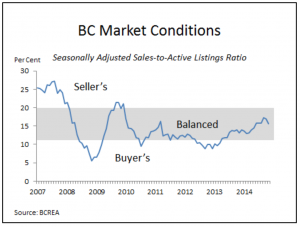

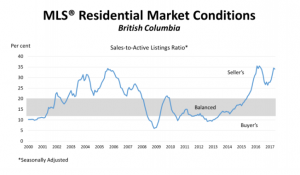

“Market conditions have tightened considerably this spring as an upturn in consumer demand has not been accompanied by a rise in homes listed for sale,” said Cameron Muir, BCREA Chief Economist. “The supply of homes for sale in the province has fallen 50 per cent over the past five years.”

“The entire southern portion of the province is experiencing a shortage of housing supply, which makes continuing upward pressure on home prices inevitable, at least in the near term,” added Muir. Total active listings in the province were down 11.1 per cent to 28,404 units from May 2016. The ratio of home sales to active listings was well over 20 per cent in nine of the province’s 11 real estate boards, and over 50 per cent in Vancouver, the Fraser Valley, Chilliwack and Victoria.

Year-to-date, BC residential sales dollar volume was down 25.2 per cent to $30.6 billion, when compared with the same period in 2016. Residential unit sales declined 20.1 per cent to 43,158 units, while the average MLS® residential price was down 5.7 per cent to $709,541.

For the complete news release, including detailed statistics, click here.